關於我們

負責任投資

負責任投資是根本。這就是我們尋求將環境、社會和治理(ESG)的考慮納入我們投資研究和管理基本方法的原因。

我們相信,這是長期財富創造不可或缺的一部分——這得益於高強度研究、積極所有權和持續學習。

投資組合經理人可以通過集中研究資料庫和投資組合管理工具獲取在我們覆蓋範圍内的負責任投資研究及分析。不同的團隊在投資決策過程中可能會或多或少,抑或不强調對ESG因素的考量。

強大的能力

積極所有權

產品方案

塑造市場

45+

ESG專家

我們的負責任投資專家透過以ESG為導向的研究、參與、投票、數據、報告、産品開發和對特定ESG投資組合的篩選,來支持我們的客戶、投資專業人士和更廣泛的商業利益。

250+

研究分析師

投資組合經理、研究分析師和ESG分析師為負責任投資團隊提供了一個關鍵的切入點,使該團隊得以進行資産類別的特定研究和參與。這使我們能夠將財務上的ESG風險分佈問題整合到我們的決策中。

40 年

負責任投資經驗

四十多年來,我們——通過我們的前身公司——一直處於負責任投資的前沿。我們的負責任投資經 驗可以追溯到 35 年前成立歐洲第一支社會和環境篩選基金。我們於 2000 年開始透過 reo® 服務參與氣候變遷議題,並於 2006 年成為責任投資原則的創始成員。

非凡卓越的全球中心

我們提供豐富的內部ESG專業知識,由我們專門的負責任投資專家團隊領導。

這是一種強大的組合,它使我們能夠利用我們投資平台上的最佳思維來滿足客戶的需求。

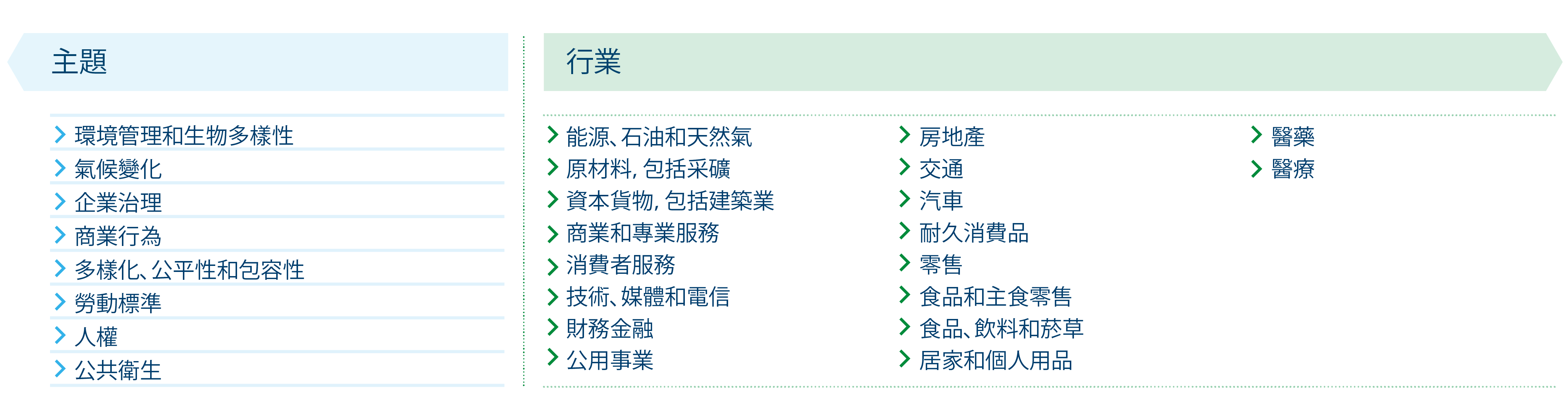

部門和行業的廣度

我們的負責任投資專家擁有廣泛的部門和專題專業知識,這可以幫助我們發展並支持廣泛的投資機會。

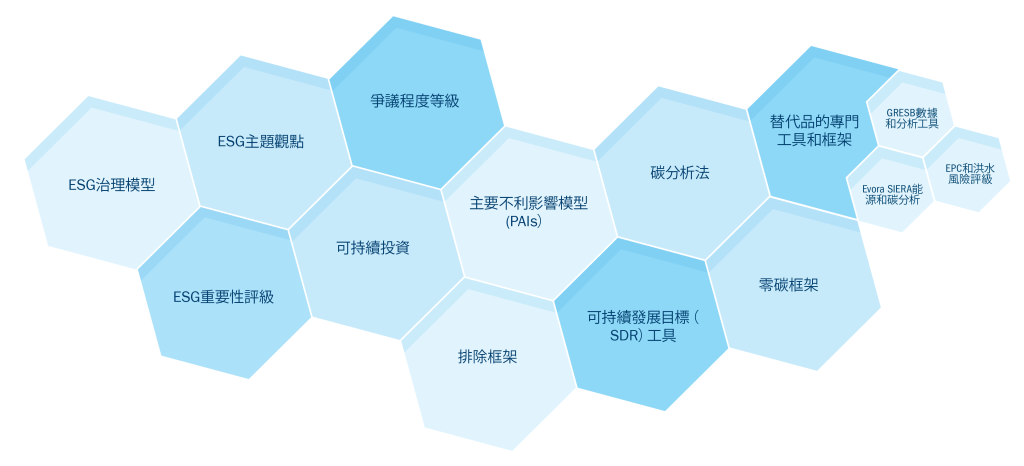

ESG工具和框架

我們擁有範圍廣泛的強大研究工具和框架,它們是我們負責任投資引擎的核心。它們將ESG融入投資研究、投資組合構建和風險監測。

這些工具的使用程度將根據客戶授權任務和戰略目標而有所不同。

利用積極主動參與和代理投票,最大限度地提高投資者價值

我們龐大且活躍的所有權團隊擁有涵蓋各行業、部門和負責任投資主題的廣泛經驗和專業知識。他們與研究分析師和投資組合經理密切合作,調查關鍵問題,並與各級組織的決策者接觸,瞭解如何管理ESG因素、風險和機會。

專注於建立信任

我們參與的主要方法是使用建設性的、保密的對話,通常我們會自行與關鍵決策者進行互動。作為長期投資者,我們重視建立在信任上的關係。

我們還和其他投資者、非政府組織(NGO)或行業團體接觸,只要是這樣做被認為符合客戶的最佳長期經濟利益。

通過代理投票創造積極的變化

我們使用代理投票來促進發行商在關鍵的ESG主題上的進展和改良,並鼓勵良好的公司治理和風險緩解做法。我們認為這是一個有效工具,它能代表客戶利益,並確保發行商不僅聽取我們的關切和偏好,而且適當地對待這些要點。

推動取得有效成果

我們製定了明確可操作的參與目標,以幫助我們展示投資者的價值。

我們的積極所有權包括範圍廣泛的ESG風險和機會,涵蓋跨部門和地區的發行商。

我們圍繞與聯合國17個可持續發展目標及其具體目標一緻的7個高層級主題展開參與。

負責任投資策略

來自世界各地的個人、機構和企業都期望我們以同時服務於其財務目標並與其價值觀一緻的方式來管理他們的資金。但最佳的負責任投資策略對每個人來說自然會有所不同。

40多年來,我們證明了我們為服務我們的客戶,創新並提供範圍廣泛的負責任投資策略的能力:

我們提供範圍廣泛的ESG資金池,涵蓋所有主要資産類別,包括多元資産和替代品。無論您負責任投資的重點或授權任務為何,我們都可以建立適合您獨特偏好的解決方案

(reo®) – 我們的責任約定覆蓋服務

我們是積極所有權的先驅,在2000年創建了我們的責任約定覆蓋 (reo®) 服務,客戶通過該服務委托我們參與並代表他們投票。 reo® 為客戶提供了我們全套的管理專長,包括:

與可持續發展目標一緻的報告詳細說明了我們參與的影響

全球跨部門覆蓋整個市值頻譜

20+積極所有權專家

23年的參與往績紀錄

請注意,reo® 服務可能無法在所有司法管轄區提供。

擁抱全球管理和問責製

作為一家大型的全球資産管理公司,我們認真對待我們的責任,幫助推動運作良好的財務金融體係。從長遠來看,這對我們的客戶和整個社會都有利。我們努力在我們所在社區成為負責任雇主和積極貢獻者。負責任是我們文化的根本。

一場大型對話的組成部分

我們透過與政策制定者和監管機構就關鍵問題進行接觸,力求將標準設定為投資者的建言,從而在公共政策製定中發揮周到的積極作用。我們透過各種行業工作組與其他投資者合作,更好地瞭解新出現的ESG問題,並與更廣泛的行業分享我們的經驗。

有目的地行事

我們是既定的負責任投資標準和規範的長期簽署者,我們緻力於改善業務的多樣性、公平性和包容性。我們還就我們業務對氣候的影響深思熟慮,並通過我們的慈善捐贈和支持參與慈善活動。我們的企業承諾包括:

英國、台灣、日本與韓國盡責管理守則的簽署人

零碳資產經理倡議簽署者

- 氣候行動100+成員

- 支持尊重人權投資者聯盟成員

- 美國投資者管理集團的簽署者,它由投資者和資産管理公司組成,促進資本管理和公司治理方面的良好實踐

- 英國女性金融業者憲章創始簽署者

Policies

Disclosures

A

Adverse impact

Aggregate sustainability risk exposure

The overall sustainability risk faced by a company or portfolio, taking account of a range of issues such as climate risk and ESG factors.

B

Best-in-class

Best-in-class strategies try to make their portfolios better on ESG issues and/or carbon characteristics by excluding certain investments deemed negative in that respect or including certain investments deemed positive in that respect.

C

Carbon footprint

The carbon emissions and carbon intensity of a portfolio, compared with its investment universe (benchmark). The benchmark might be, for example, companies in the FTSE 100.

Carbon intensity

A company’s carbon emissions, relative to the size of the business. This allows investors to compare the company’s carbon efficiency with its competitors』.

Climate risk

The risk that an investment’s value could be harmed by climate issues such as global warming, energy transition and climate regulation. Investors normally assess climate risk by looking at carbon footprint data, climate adaptation risk, physical risk and stranded assets.

Climate adaptation risk

See Transition Risk.

Controversies

A company’s operational failures or everyday practices that have severe consequences for workers, customers, shareholders, wider society and the environment. Examples are poor employee relations, human rights abuses, failure to follow regulations, and pollution. Controversies help to indicate the quality of a company.

Corporate governance

The way that companies are organised and led. We look at how well companies are sticking to good practices set out in Corporate Governance Codes, which vary from country to country. Corporate governance is also part of the 『G』 in ESG. In this context Governance may focus on the operational and management practices relating to social and environment aspects of the business.

Corporate Social Responsibility (CSR)

A company’s approach to (and engagement with) its stakeholders and the communities it operates in, reflecting its responsibility towards people and planet.

D

Decarbonisation

The reduction of the carbon emissions associated with a region, country, industry or organisation. It can also refer to the reduction of the carbon emissions associated with a fund’s investments.

Divestment

The opposite of investment. In other words, either reducing or exiting an investment. We divest if we think the potential risks of investing in a company outweigh the potential returns. This may be because we have lost confidence in a company’s leadership, strategy, practices or prospects .

E

Engagement

Talking to members of the board or management of a company – a two-way process that we might initiate, or the company might initiate. We use engagement to understand companies better. We also use it to give feedback, offer advice and seek changes – including change relating to ESG and climate risk. Engagement also means consulting with government and collaborating with other investors to influence policy and shape debate.

Environmental

The 「E」 in ESG. This covers a focus on significant environmental risks and their management. In a climate change context it is a focus on the risks associated with a business having to adapt to climate change requirements or the physical impacts of climate change. We also look at companies』 environmental opportunities due to changing consumer demands, policy changes, technology and innovation.

ESG

Short for environmental, social and governance. Investors consider companies』 ESG risks and how well they are managed. To do this, we use the Sustainability Accounting Standards Board (SASB) framework. Considering ESG gives us a different perspective on how good an investment might be.

ESG integration

Always taking account of ESG issues when assessing potential investment opportunities and monitoring the investments in a portfolio.

ESG ratings

Many investment managers use external providers, such as MSCI, to rate companies on their ESG practices. Each provider has its own way of doing things, so ESG scores can vary radically from one provider to another. We run our own ESG system to rate companies. This is based on 77 standards, each for a different industry, produced by the Sustainability Accounting Standards Board.

Ethical investing

An ethical approach excludes investments that conflict with the client values and ethics that a fund is seeking to reflect. There are many different activities or issues that people prioritise as ethical. Common examples include tobacco, adult entertainment, controversial weapons, coal or activities that contravene religious social teaching.

Exclusion

Excluding companies from a portfolio. Exclusions can also be used to set minimum standards or characteristics for inclusion of investments in portfolios. Fund managers may exclude entire industries (e.g. tobacco), companies involved in ethically questionable activities (e.g. gambling), companies that fail to meet certain ESG standards, and companies with a bad carbon intensity.

F

Fundamental analysis/research

Using research to work out the true value of an investment, rather than its current price. Many factors contribute to this, including responsible investment factors. Responsible investment helps us understand the quality of a company, its scope to develop and improve (e.g. in response to climate transition) and its prospects (through making money from responding to sustainability issues). Even if a company is good, it is unlikely to offer good investment returns if this is already reflected in the share price.

G

Green bonds

Debt issued by companies or governments, with the money raised earmarked for green initiatives such as building renewable energy facilities.

Greenwashing

Insincere approaches to climate change and other ESG issues by companies, including investment management firms. For example, an investment manager may label a fund as an ESG fund, even if it does not adopt ESG integration in practice.

I

Impact investing

International Labour Organisation (ILO)

A United Nations agency, often abbreviated to 「ILO」, that sets international standards for fairness and safety at work. The ILO standards are commonly used by investors to assess how serious a corporate controversy is.

M

Materiality

An ESG issue is 「material」 if it is likely to have a significant positive or negative effect on a company’s value or performance.

N

Norms-based screening

Screening investments for potential controversies by looking at whether a company follows recognised international standards. We consider standards including the International Labour Organisation standards, the UN Guiding Principles for Business and Human Rights and the UN Global Compact. Specialist RI funds may exclude companies that do not meet these standards.

P

Physical risk

The physical risks of climate change for businesses, such as rising sea levels, water shortages and changing weather patterns.

Portfolio tilts

Investment industry jargon for having more of something in a portfolio than the benchmark, or less of it. In responsible investment it usually means having more companies in a portfolio that have better ESG credentials or are less exposed to climate risk than there is in the benchmark. The tilt is measured as the overall exposure to a specific type of investment in a portfolio compared to that in the benchmark.

Positive inclusion/screening

Seeking companies that have good ESG practices or that help the world economy be more sustainable. Also used as an alternative to 「best-in-class「. The opposite of exclusion.

Principles for Responsible Investment

Often shortened to PRI. A voluntary set of six ethical principles that many investment companies have agreed to adopt. Principle 1, for example, is: 「We will incorporate ESG issues into investment analysis and decision-making processes.」 The PRI was sponsored by the United Nations. Columbia Threadneedle is a founding signatory, and has attained the top A+ headline rating for its overall approach for the sixth year running.

Proxy voting

Voting on behalf of our clients at company general meetings to show support of their practices and approach – or to show our dissent. We put our voting record on our website within seven days of the vote.

R

Responsible Investment (RI)

The umbrella term for our approach towards managing our clients』 money responsibly. This includes the integration of ESG factors, controversies, sustainability opportunities and climate risks into our investment research and engagements with companies, to inform our investment decisions and proxy voting.

Responsible Investment Ratings

Mathematical models created by our responsible investment analysts that provide an evidence-based and forward-looking indication of the quality of a business and its management of risk.

S

Scope 1, 2 and 3 emissions

The building blocks used to measure the carbon emissions and carbon intensity of a company. Under an international framework called the Greenhouse Gas Protocol these are divided into Scope 1, 2 and 3 emissions. Scope 1 emissions are generated directly by the business (e.g. its facilities and vehicles). Scope 2 covers emissions caused by something a company uses (e.g. electricity). Scope 3 is the least reliable because it is the hardest to measure. It covers other indirect emissions generated by the products it produces (e.g. from people driving the cars a company makes).

Screened funds

Funds that use screens to exclude companies that do not meet their ethical criteria, ESG expectations, carbon intensity or controversy standards.

Social

The 「S」 in ESG. Investors analyse social risks and how these are managed. This includes a company’s treatment of its employees and its human rights record for other people outside the company (e.g. in the supply chain). It also refers to a company’s commercial opportunities in responding to changing consumer demands, policy changes or technology and innovation (e.g housing, education or healthcare).

Social bonds

Bonds issued to raise money for a socially useful purpose, such as education or affordable housing. Social bonds follow the standards set by the International Capital Market Association (ICMA) and appoint independent external reviewers to confirm the money raised will be used appropriately.

Socially Responsible Investing (SRI)

A form of ethical investment that attaches particular importance to avoiding harm to people or the planet, from the investments being made.

Stewardship

A catch-all term to describe the actions taken to look after our clients』 money. It commonly involves both engagement with companies, to develop a proper understanding of business developments, issues and potential concerns; and proxy voting to support or oppose issues at company general meetings.

Stranded assets

A variety of factors can lead to the risk of assets becoming stranded, such as new regulations or taxes (e.g. carbon taxes or changes in emission trading schemes) or changes in demand (e.g. impacts on fossil fuels, resulting from the shift towards renewable energy). Stranded assets risk having their value written down, impacting the value they have in a company’s accounts.

Sub-advisor

When one investment management company hires another investment management company to manage one of their funds, the hired company is the sub-advisor. Sub-advisors are sometimes used in responsible investment if they have specialist knowledge of this field that does not exist in-house.

Sustainability Accounting Standards Board

Often referred to as 「SASB」, this is a non-profit organisation that sets standards for the sustainability information companies should communicate to their investors. It has produced 77 sets of industry-specific global standards. SASB looks for sustainability issues that are financially significant to a particular industry.

Sustainability risk

An environmental, social or governance risk that could hit the value of an investment.

Sustainable Development Goals (SDGs)

A set of 17 policy goals set out by the United Nations, which aim for prosperity for all without harming people and the planet. Each goal has a number of targets. For example, Goal 2 is Zero Hunger and Target 2.3 is to double the productivity and incomes of small-scale food producers. Companies can contribute to the SDGs by making products or services that help achieve at least one of the 17 goals.

Sustainable investing

Investing in a way that recognises the need for and supports balanced social, environmental and economic development for the long term.

T

Task Force on Climate-related Financial Disclosures (TCFD)

The Task Force on Climate-Related Financial Disclosures was set up by the World Bank to help companies communicate their climate risks and opportunities and how they manage them. The TFCD sets out a framework for communicating how management considers climate risks, its strategy for responding to climate change, risk management arrangements and the types of risk covered. The TCFD says companies should, for example, explain how their business strategies would cope in different temperature scenarios. From 2022 companies listed on the UK stock market will have to follow the TCFD’s recommendations for disclosing climate risks.

EU SFDR (Sustainable Finance Disclosure Regulation)

This forces funds to communicate how they integrate sustainability risk and consider adverse impacts. For funds promoting environmental or social characteristics or that are targeting sustainability objectives, additional information will need to be communicated.

The EU Taxonomy

Often called the 「Green Taxonomy」. This is the EU’s system for deciding whether an investment is sustainable. Investments must contribute to one or more environmental objectives and meet the detailed criteria required for each activity or product that contributes to this. Investments must not do significant harm to any of the objectives. They must also meet minimum standards in business practices, labour standards, human rights, and governance.

Thematic investing

Researching global trends, or 「themes」, to identify investments that will either benefit from changing needs or be impacted by them. Common themes are climate change and technological innovation. Often combined with sustainable investing, which looks at these trends but with an additional focus on the environmental or social implications of themes.

Transition risk

The potential risks faced by companies as society transitions towards alignment with the Paris Agreement to limit global warming. This is the risk that a company is so invested in certain incompatible operations and assets that it is uneconomical to transition to align with the Paris Agreement.

U

UN Global Compact (UNGC)

The world’s largest sustainability initiative. The UNGC sets out a framework based on Ten Principles for business strategies, policies and practices, designed to make businesses behave responsibly and with moral integrity. Companies can volunteer to sign the Compact, and can be struck off by the UN for breaking it. The Compact is commonly used by investors to assess how serious controversies are.

UN Guiding Principles for Business and Human Rights

A framework for companies to prevent human rights abuses caused by their activities. Commonly used by investors to assess the severity of companies』 human rights failures.

Important information

For marketing purposes. Your capital is at risk. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. Not all services, products and strategies are offered by all entities of the group. Awards or ratings may not apply to all entities of the group.

This material should not be considered as an offer, solicitation, advice, or an investment recommendation. This communication is valid at the date of publication and may be subject to change without notice. Information from external sources is considered reliable but there is no guarantee as to its accuracy or completeness. Actual investment parameters are agreed and set out in the prospectus or formal investment management agreement.

In the UK: Issued by Threadneedle Asset Management Limited, No. 573204 and/or Columbia Threadneedle Management Limited, No. 517895, both registered in England and Wales and authorised and regulated in the UK by the Financial Conduct Authority.

In the EEA: Issued by Threadneedle Management Luxembourg S.A., registered with the Registre de Commerce et des Sociétés (Luxembourg), No. B 110242 and/or Columbia Threadneedle Netherlands B.V., regulated by the Dutch Authority for the Financial Markets (AFM), registered No. 08068841.

In the Middle East: This document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it.

In Australia: Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414 and/or Columbia Threadneedle EM Investments Australia Limited [“CTEM”], ARBN 651 237 044. TIS and CTEM are exempt from the requirement to hold an Australian financial services licence under the Corporations Act and relies on Class Order 03/1102 and 03/1099 respectively in marketing and providing financial services to Australian wholesale clients as defined in Section 761G of the Corporations Act 2001. TIS is regulated in Singapore (Registration number: 201101559W) by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289), which differ from Australian laws. CTEM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.

In Singapore: Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, which is regulated in Singapore by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289). Registration number: 201101559W. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Japan: Columbia Threadneedle Investments Japan Co., Ltd. Financial Instruments Business Operator, The Director-General of Kanto Local Finance Bureau (FIBO) No.3281, and a member of Japan Investment Advisers Association.

In Hong Kong: Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司, Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 1 regulated activities (CE: AQA779). Registered in Hong Kong under the Companies Ordinance (Chapter 622), No. 1173058 and/or issued by Columbia Threadneedle AM (Asia) Limited, Unit 3004 Two Exchange Square, 8 Connaught Place, Central, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 4 and Type 9 regulated activities (CE: ABA410). Registered in Hong Kong under the Companies Ordinance (Chapter 622), No. 14954504.