Inflation: No time to panic

Earlier in 2021 we predicted that the reopening trade, coupled with supply chain issues, would create a transitory inflationary environment, which it has. While this transitory period is lasting longer than anticipated, our view remains that inflation will moderate as we go through 2022.

Helpfully, central banks continue to look through inflationary pressures; for example the US Federal Reserve has not appeared overly concerned by higher and persistent US inflation, which in previous cycles would have been perceived as a major headwind. Investors and markets, too, are fairly sanguine. Equity markets are at highs, buoyed in some areas by strong M&A (most obviously in the UK), while the steepening and flattening yield curve has been interesting to watch without causing as much consternation as we might expect. This is in stark contrast to previous talk of shifts in monetary policy in 2013 and 2018 which induced negative market reactions, not least the taper tantrum. Now, the market feels more poised, having waited so long for clarity. This makes us more confident for 2022, albeit in a slowing growth environment.

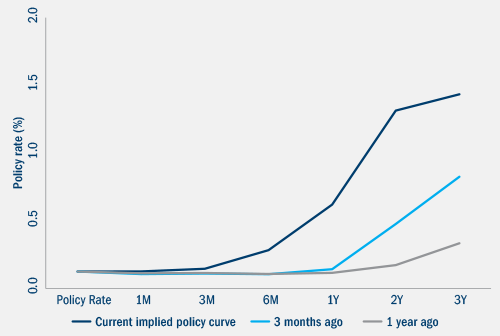

Figure 1: US interest rate expectations and history

Source: Bloomberg, Columbia Threadneedle Investments, as at 8 November 2021.

One reason we believe inflation will ultimately fall in 2022 is due to improvements in the supply chain. Regardless of whether you believe Covid or other structural and political factors (in Europe especially) are to blame, many of us underestimated the degree to which the supply chain would impact the corporate backdrop. If overordering then falls, there remains the risk of an inventory-led recession in some areas, notably automobiles and semi-conductors, as manufacturers who underestimated order levels during the pandemic have depleted inventories to cope. Indeed, recent estimates from industry analysts see semiconductor shortages extending into 2023.

But despite the ongoing challenge of disruption at transport hubs and a shortage of labour, we have seen recent signs of improvement. In some sectors, notably retail, companies continue to benefit from a less concentrated and more agile supply chain, while manufacturers, transporters and retailers are all working hard to make up ground lost in 2021 against steady consumer demand. It is our belief that the supply chain headwinds will continue to become less dominant in 2022, but it may well be towards the latter half of the year before the positive impacts are felt.

Quality will out

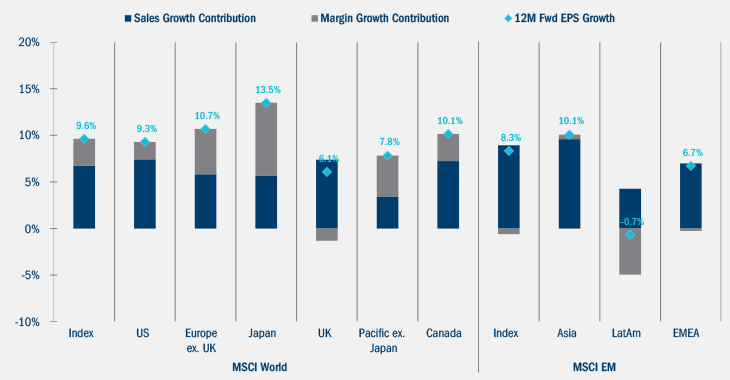

Figure 2: global 12-month forward earnings per share growth expectations

Source: Datastream/IBES, September 2021.

But given those supply chain bottlenecks and the persistence of inflation, it will be harder for companies to beat forecasts in the way they have in 2021, at least in the short term. For companies, we anticipate next year will be a return to the familiar cycle of earnings disappointment as opposed to positive surprises.

In previous cycles when the yield curve has flattened, the impact on equities has seen investors seek quality companies that could survive any impending rates shock. As we near the end of 2021 we have seen the yield curve steepen, flatten and rise across the curve again, and that has led to a more mixed scenario in terms of what is leading the market – I do not see that changing in the short term, but some areas that outperformed more recently might struggle, such as “meme” stocks – those that become popular among retail investors through social media platforms. The companies we like – quality businesses with solid balance sheets and competitive advantages – stand a better chance of weathering volatility.

Fixed income

Equities

It will be harder for companies to beat forecasts in the way they did in 2021, at least in the short term. In fact, I expect a greater variation in equity results through the year, and that environment will present opportunities for active investors. The continuing reopening trade (and an environment of above-average GDP growth) presents opportunities for cyclical outperformance, particularly in the first half of the year, but even this play will have uneven winners and losers. As stated, by quality we mean companies with solid balance sheets, strong competitive advantages and strong sustainability credentials. Regardless of region, it is our belief these companies will survive any slowdown or volatility in 2022.

Regions

Looking regionally, investors have turned away from China in droves this year because of its well-publicised regulatory crackdown coupled with an imbalanced property market. I recognise the concerns about regulation, not to mention outbreaks of Delta Covid strains, extreme weather affecting food production and transportation, and slowing growth. But China recovered first from Covid, and did so with a tighter policy framework than other regions. While growth in the country is of major concern, to my mind that increases the likelihood of Chinese authorities providing stimulus in 2022 – so I have a balanced view. There is opportunity in China (and the rest of the emerging markets universe) but it requires fundamental research and a bottom-up approach – building portfolios company-by-company rather than a thematic approach.

In Japan, Prime Minister Fumio Kishida does not represent a positive catalyst in the way Abe did. Without this political spark and the expectation of meaningful change, Japan has become a less exciting region for us as investors, notwithstanding improvements in supply chains that will help the country’s industrial nature. That said, as active investors we are not devoid of opportunities and there is often more breadth in the Japanese market than we give it credit for, not least in the technology and service sectors. The latter is unusual given Covid, but there are ongoing initiatives designed to improve productivity that are unearthing opportunities for us.

The UK savings industry has typically been invested to the tune of 60% in sterling-based assets, but recently domestic investors have looked more globally for risk-adjusted returns. This has been the right call given the UK equity market has been a serial underperformer, and continues to be hit by lower flows. But corporate entities with deep pockets do not care about flows; they care about identifying cheap and undervalued assets they can acquire – opportunities which are plentiful in the UK. It is possible to over-emphasise the extent to which Brexit is playing a part in the UK and European economies. What we do know is that the UK is a less open economy than it was five years ago – and that will continue to be a factor, creating both opportunities and challenges.

Looking to Europe, we expect strong growth, albeit with the potential for supply chain shocks, already evident in the lack of HGV drivers and reduced labour pool. These factors will likely lead to higher than anticipated inflation and peak stimulus. There is also a theme of change in the region: Angela Merkel in Germany has stepped down – a Germany led by the SPD’s Olaf Scholz along with the Greens and FDP could see more volatility and a preponderance of stimulus. Added to that we have a presidential election in France in April – and French elections are notoriously difficult to predict. As events these will be market influencers, but to what extent it is difficult to estimate.

Conclusion

2022 will be a year of change. We have had an environment of fiscal and monetary stimulus for some time, and when taps are kept open investors do not mind how much governments and central banks spend or how big a national deficit is. But change is coming, however unwanted it might be, and we face a world of economic repair in which markets and investors must consider the impact of reduced fiscal stimulus.